Category Archives: Uncategorized

Fall/Winter 2023-2024

Winter 2023 Vogtle News

MEAG Power, Participant & Public Power News

Fall/Winter 2022-2023

Vogtle News

Plant Vogtle Unit 3 Continues Operation at 100% Power; Unit 4 Power-Ascension Testing Has Resumed

Unit 3 entered commercial service on July 31, 2023, adding 250 MW of emissions-free generation capacity to MEAG Power’s portfolio. Unit 4 has resumed power-ascension testing after replacement of the damaged 2A reactor coolant pump was completed. Unit 4 COD is projected for the first quarter of 2024.

On July 31, Plant Vogtle Unit 3 entered commercial service, adding 250 MW of emissions-free generation capacity to MEAG Power’s portfolio, an equivalent amount to power an estimated 113,500 homes and businesses. Vogtle Unit 3 is the first newly constructed nuclear unit to enter service in the U.S. in more than 30 years.

“Vogtle Unit 3 entering commercial service is a monumental achievement that reflects the tremendous hard work, dedication and perseverance of thousands of workers on-site, as well as all the current and past employees of MEAG Power and the Unit’s other co-owners, MEAG Power Board members and the countless utility and city government employees of the 49 Participant communities we serve across Georgia,” said MEAG Power President & CEO Jim Fuller.

“Bringing Vogtle Unit 3 to commercial operation – and continuing the work on Unit 4 toward an in-service date early next year – highlights MEAG Power’s commitment to serving the needs of our Participant communities,” Fuller continued. “Vogtle Units 3 & 4 will provide up to 500 MW of clean energy to our Participant communities for the next 60 to 80 years – providing critical non-emitting power to present and future generations.”

Since entering service on July 31, Unit 3 has operated at 100% power, and by year-end will have surpassed 3 million net MWh of generation for the state.

Unit 4 Update

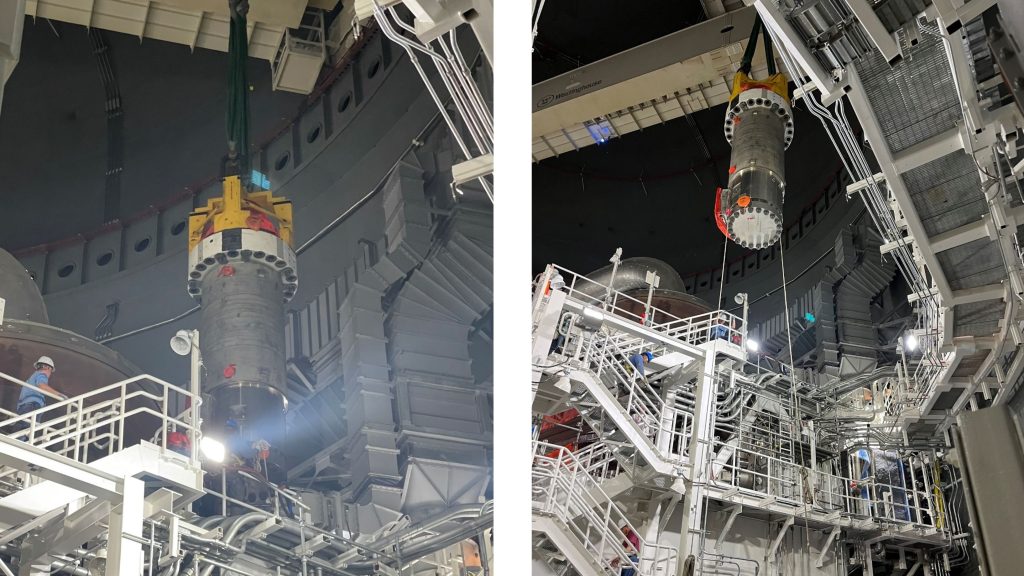

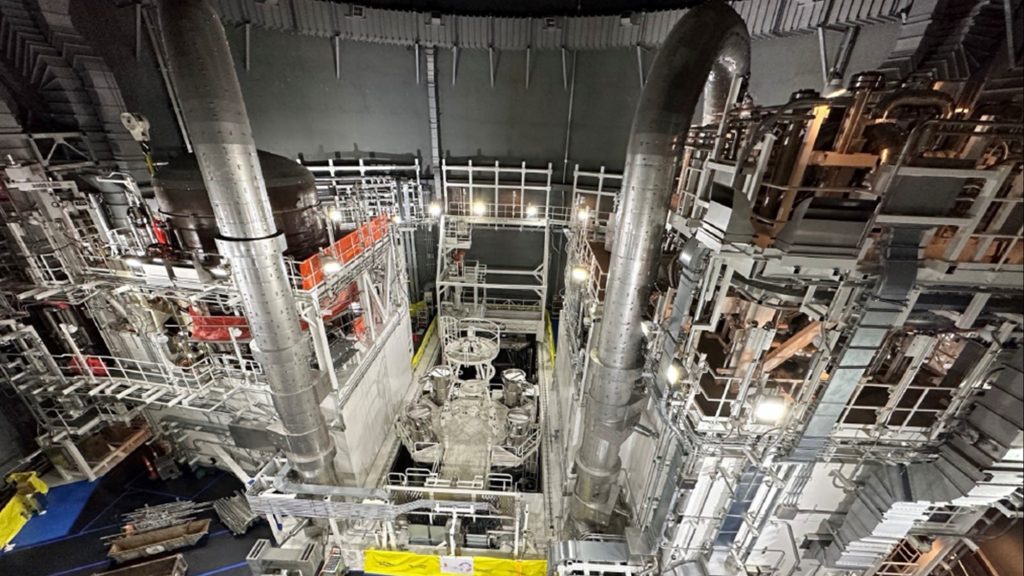

Unit 4 had achieved Mode 4 on Sept. 21 and Mode 3 on Sept. 25, and the turbine had been placed on turning gear. On Sept. 28, the 2A reactor coolant pump (RCP) tripped off-line. An investigation determined the cause to be a fault in the RCP motor. A spare RCP at the site was put into service to replace the failed RCP.

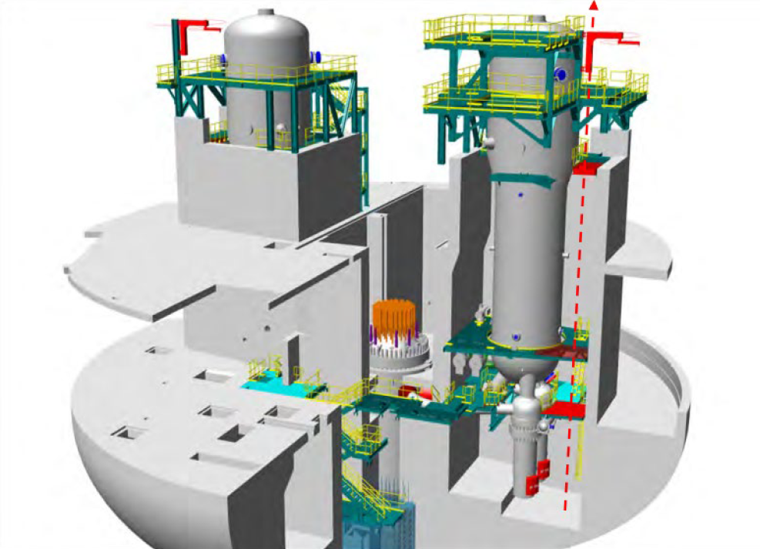

The replacement required the pump assembly being lifted out on a path (red dashed line in graphic above; photos showing actual pump removal) up containment, alongside the steam generator. This process required the removal and replacement of approximately 550 interferences in that path. Staff with experience in pump replacement in China were on-site for the removal and replacement, which was completed in November – after which the interferences had to be replaced.

At this point, start-up and power ascension testing continued. While the pump replacement work was ongoing, start-up activities for the turbine systems continued.

Unit 4 COD is projected for the first quarter of 2024.

Quick Links:

Meetings & Events

-

-

Participant Dinner in conjunction with GMA Cities United

Jan. 28, 6 p.m. - 9 p.m. -- Commerce Club, Atlanta

See details

-

MEAG 101 for Newly Elected Officials

Jan. 29, 12 p.m. - 2 p.m. -- Commerce Club, Atlanta

See details

Other Resources

Current is published by MEAG Power

1470 Riveredge Parkway, N.W., Atlanta, Georgia 30328 | www.meagpower.org | (800) 333-MEAG

GridEx VII

MEAG Power, Participant & Public Power News

Fall/Winter 2023-2024

GridEx VII Presents Numerous Challenges to Staff and Participants

The biennial exercise, hosted by NERC’s Electricity Information Sharing and Analysis Center, provided a forum to practice response and recovery from cyber and physical security threats and incidents.

On Nov. 14 and 15, MEAG Power participated in GridEx VII, the seventh biennial grid security and resilience exercise, hosted by NERC’s Electricity Information Sharing and Analysis Center (E-ISAC). GridEx provided a forum to practice response and recovery from cyber and physical security threats and incidents, both across the industry and internal to MEAG Power.

The largest grid security exercise in North America, GridEx VII saw more than 250 organizations take part. Security professionals played simultaneously in a complex and challenging scenario while adapting the exercise to meet their specific organizational needs. This year’s scenario reflected real-world cyber and physical threats and was designed to stress-test crisis response and recovery plans.

MEAG Power has participated in all seven iterations of GridEx – each time bringing in more employees across various departments to more closely approximate a real-world experience. This year, 26 MEAG Power employees from four departments participated, including five executives in differing roles. And, for the first time, two Participants were part of the exercise, adding another level of realism.

For the two days of GridEx, the MEAG Power Board room becomes a command center, with clusters of desks and computers arrayed around the room, bringing together specific groups and departments to help strategize and coordinate responses to the various “injects” – the specific, detailed cyber and/or physical security incidents happening across the state, the country and within MEAG Power.

Each cluster works both together and independently, based on each staff member’s role in the organization, to respond in kind to the various scenarios put forth.

At the close of the exercise, MEAG Power holds a debrief session to discuss the lessons learned in order to help improve processes and incident responses going forward.

NERC and the E-ISAC apply the overall outcomes and lessons learned from GridEx exercises to help improve the security of the North American grid. The GridEx Lessons Learned Reports from previous exercises are available under the “GridEx Public Reports” section on NERC’s website.

The E-ISAC will develop the report on GridEx VII with input from all participants scheduled to be released by the end of the first quarter of 2024.

Quick Links:

Meetings & Events

-

-

Participant Dinner in conjunction with GMA Cities United

Jan. 28, 6 p.m. - 9 p.m. -- Commerce Club, Atlanta

See details

-

Participant Dinner in conjunction with GMA Cities United

Jan. 29, 12 p.m. - 2 p.m. -- Commerce Club, Atlanta

See details

Other Resources

Current is published by MEAG Power

1470 Riveredge Parkway, N.W., Atlanta, Georgia 30328 | www.meagpower.org | (800) 333-MEAG

Georgia Record Economic Development

MEAG Power, Participant & Public Power News

Fall/Winter 2023-2024

Georgia Continues Record Economic Development in Fiscal Year 2023

Record-breaking economic development during Fiscal Year 2023 included investments in facility expansions and new locations that totaled more than $24 billion, resulting in 38,400 new jobs through 426 projects.

The Georgia Department of Economic Development (GDEcD) recently announced that for the third year in a row the state broke records for economic development during Fiscal Year 2023 (FY23). In FY 23, total investments in facility expansions and new locations totaled more than $24 billion, resulting in 38,400 new jobs through 426 projects supported by GDEcD’s GlobalCommerce team.

When excluding the two largest projects in state history – Rivian and Hyundai Motor Group – from the previous year’s job creation figures, total jobs as a result of FY23 projects exceeded the previous record by more than 2,800 new positions. Annual investment totals have also increased by 131 percent over the last three years.

Eighty-two percent of new jobs created and more than $20 billion in investments are on their way to communities outside the 10-county Atlanta region. A magnet for industries like financial technology and life sciences, Metro Atlanta also continues to play a critical role in the state’s overall economy, attracting $3.6 billion in investment last fiscal year. Expansions account for 71 percent of total projects, and new locations for 65 percent of new jobs announced across the state.

Georgia has remained on the cutting-edge of the future of mobility. Between July of 2018 and July of 2023, at least 40 e-mobility projects have been announced, committing more than 30,000 jobs and over $25 billion in investment to the state. This past fiscal year, job creation in the automotive industry increased by 324 percent when compared to FY21, and suppliers attracted by Georgia’s mobility original equipment manufacturers (OEMs) resulted in over $2 billion in investment across the state in FY23. Mobility and cleantech projects alone delivered three investments of $1 billion or more and six of the largest projects by job creation– a result of fostering innovation in the state with the support of organizations like the Georgia Center of Innovation, which connects public and private partners in strategic ecosystems.

Furthermore, partnerships with community and state partners on speed-to-market and work force solutions like the “Georgia Ready for Accelerated Development” (GRAD) certification and Georgia Quick Start programs spurred a 112 percent growth in advanced manufacturing investments since FY21.

Georgia also benefits from a reliable logistics industry that extends throughout the state along a robust network of top-ranked highways and accessible railways. With ample cold storage space, key sectors like agriculture – the state’s number one industry – and food processing are able to safely transport products to local groceries and markets across the U.S. and abroad. Agribusiness-related job creation grew by 29 percent compared to FY21.

Quick Links:

Meetings & Events

-

-

Participant Dinner in conjunction with GMA Cities United

Jan. 28, 6 p.m. - 9 p.m. -- Commerce Club, Atlanta

See details

-

MEAG 101 for Newly Elected Officials

Jan. 29, 12 p.m. - 2 p.m. -- Commerce Club, Atlanta

See details

Other Resources

Current is published by MEAG Power

1470 Riveredge Parkway, N.W., Atlanta, Georgia 30328 | www.meagpower.org | (800) 333-MEAG

New Participant Pages

MEAG Power, Participant & Public Power News

Fall/Winter 2023-2024

New Participant Pages to Launch on MEAG Power Corporate Website

Hosted on the MEAG Power corporate website, the new Participant Pages will provide an array of useful information in a totally updated and graphically modern format, including numerous new features.

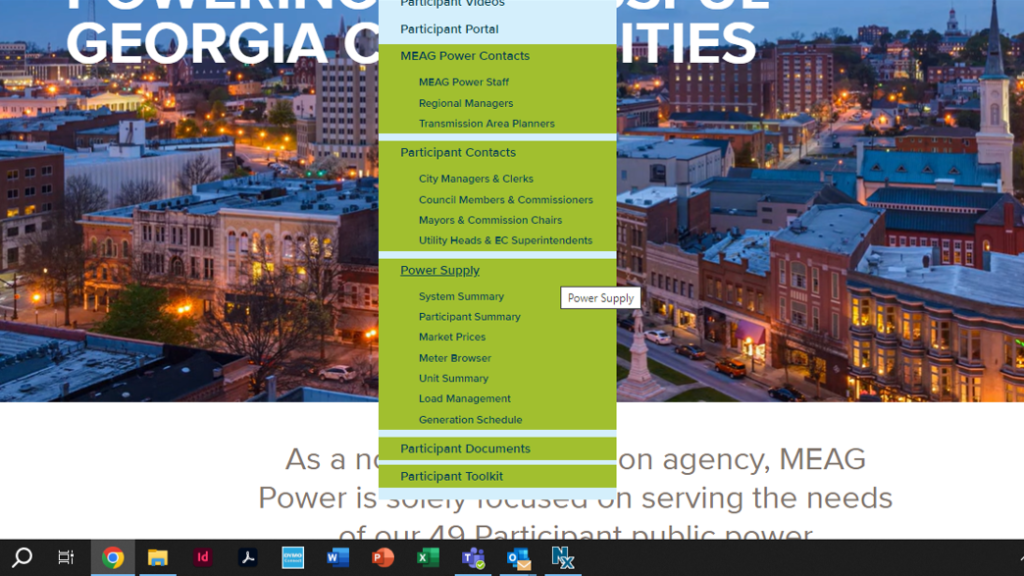

After a pilot testing program, MEAG Power will launch the new Participant Pages on its corporate website early in 2024, providing an array of useful information to Participants in a totally updated and graphically modern format, including numerous new features. The new Participant Pages will replace the existing Participant Portal.

The new Participant Pages, which will be accessible using proprietary login credentials, will feature navigation elements on a green background — as shown in the screen shot above. Publicly accessible information on the MEAG Power corporate site remains on the light blue background across the site (as indicated in the screen shot below, which shows both public and Participant navigation links).

Included in the new Participant Pages — under the Participants main navigation tab — are searchable, categorized Contacts for both MEAG Power staff and Participants, Power Supply data for both the MEAG Power system and individual Participants, a Documents section to access billing and related information, and a new Participant Toolkit that contains marketing-related resources available for Participant use. Also, under the Resources main navigation tab, are new Under the Domes and Legislative Guide pages, housing MEAG Power’s state legislative newsletters and our annual list of both state and federal legislator contacts produced for MEAG Power Participants and ECG members.

The new Participant Pages were built on the same platform MEAG Power implemented to build the new corporate website, launched in December 2020. We continue to utilize the framework of that robust platform to roll out additional website pages and functional tools such as the online registration and Event pages used for our annual events including the Annual Meeting and Mayors Summit, among others. In short, the corporate site was envisioned — and is being used as — the hub for all such public and Participant information and tools.

NOTE: After the pilot testing period, the new Participant Pages will be rolled out to all Participants in early 2024. Participants seeking login credentials for the new Participant Pages should contact your Regional Manager.

Quick Links:

Meetings & Events

-

-

Participant Dinner in conjunction with GMA Cities United

Jan. 28, 6 p.m. - 9 p.m. -- Commerce Club, Atlanta

See details

-

MEAG 101 for Newly Elected Officials

Jan. 29, 12 p.m. - 2 p.m. -- Commerce Club, Atlanta

See details

Other Resources

Current is published by MEAG Power

1470 Riveredge Parkway, N.W., Atlanta, Georgia 30328 | www.meagpower.org | (800) 333-MEAG

2023 Mayors Summit Article

MEAG Power, Participant & Public Power News

Fall/Winter 2023-2024

Engaging Speakers and Issues Highlight 2023 Mayors Summit

Guest presenters, including experts in the energy industry and economic development, as well as the state political realm, highlighted a program that provided Participant Mayors and Board/Commission Chairs a wealth of information.

In November, MEAG Power held its 29th annual Mayors Summit, a forum where Participant Mayors and Board/Commission Chairs and their designees can share experiences, discuss the political, economic and industry environments, and build on the relationships that are the foundation of the MEAG Power family.

In addition to the traditional Open Discussion with Mayors, in which all attendees are invited to share their views on the most important issues of the day affecting Participant communities, a Mayors-only session allows Participant leaders to debate events amongst themselves.

The day-long general session featured speakers who provided an array of knowledge and insight to help Participant and MEAG Power leaders more deeply understand some of the most important issues of the day. Speakers delved into topics ranging from the state’s robust economic development to cybersecurity to a detailed debrief on how Georgia’s electricity market structure provides a significant advantage in providing a reliable and economical energy supply. Attendees also heard an update on the state’s political scene from Joel Wiggins, who will be assisting MEAG Power’s Government Relations staff during the upcoming legislative session.

The presentations from the Mayors Summit included:

The New Georgia Economy – Chris Clark, President & CEO, Georgia Chamber of Commerce

Georgia’s Energy Outlook – Kim Greene, President & CEO, Georgia Power

State Political Scene – Joel Wiggins, The Southern Group

Georgia’s Advantageous Electricity Market Structure – Dr. David Gattie, Associate Professor of Engineering, University of Georgia

MEAG Power greatly values the insight and input from Participant Mayors and Board/Commission Chairs in helping MEAG Power leadership and staff formulate the appropriate approaches to dealing with all the major issues of the day.

NOTE: The presentations are posted on a private Event Page on the MEAG Power website. If you would like to access the presentations and did not attend the event, please email us at events@meagpower.org to receive the URL. (If you attended Mayors Summit, please use the previously provided URL.)

Quick Links:

Meetings & Events

-

-

Participant Dinner in conjunction with GMA Cities United

Jan. 28, 6 p.m. - 9 p.m. -- Commerce Club, Atlanta

See details

-

MEAG 101 for Newly Elected Officials

Jan. 29, 12 p.m. - 2 p.m. -- Commerce Club, Atlanta

See details

Other Resources

Current is published by MEAG Power

1470 Riveredge Parkway, N.W., Atlanta, Georgia 30328 | www.meagpower.org | (800) 333-MEAG

2023 Mayors Summit Event Page

2023 Mayors Summit

November 10-12

Welcome to the Chateau Elan Winery & Resort!

This annual event is designed to focus on issues of relevance to — and gain input from — Participant Mayors and/or Board/Commission Chairs. If you are unable to attend, please ensure that you designate a person to represent your community.

MEAG Power relies on Mayors’ and Board/Commission Chairs’ voices in Washington, D.C., and at the State Capitol to ensure the future success of municipal electric systems in Georgia. A mix of MEAG Power business and operations updates, along with guest speakers and political analysis, highlight the program.

Meeting attire–Business Casual; Evening activities–Dressy Casual

Quick Links:

Event Materials:

Post-Event:

MEAG Power

1470 Riveredge Parkway, N.W., Atlanta, Georgia 30328 | www.meagpower.org | (800) 333-MEAG

Participants APPA RP3 Awards

MEAG Power, Participant & Public Power News

Summer 2023

Marietta Among the 109 Public Power Utilities to Receive Coveted RP3 Designation from APPA

Joins Five other Participants Holding RP3 Designation: City of Calhoun, Albany Utilities, the City of Cartersville Electric System, Fort Valley Utility Commission and Newnan Utilities.

In May, the American Public Power Association (APPA) recognized 109 of the nation’s more than 2,000 public power utilities as winners of the Reliable Public Power Provider (RP3) designation for providing reliable and safe electric service. Among those named was Marietta Power, at the Diamond Level.

A total of 271 public power utilities nationwide hold the RP3 designation, including five other MEAG Power Participants: (Diamond Level) City of Calhoun; (Platinum Level) Albany Utilities; (Gold Level) City of Cartersville Electric System, Fort Valley Utility Commission, Newnan Utilities.

The RP3 designation, which lasts for three years, recognizes public power utilities that demonstrate proficiency in four key disciplines: reliability, safety, workforce development, and system improvement. Criteria include sound business practices and a utility-wide commitment to safe and reliable delivery of electricity.

“Receiving an RP3 designation is a great honor signifying a utility has demonstrated commitment to industry best practices,” said Troy Adams, Chair of APPA’s RP3 Review Panel and General Manager at Manitowoc Public Utilities, Wisconsin. “And ultimately, the culture developed from this pursuit of excellence and continued improvement through the RP3 program results in measurable value delivered to the local community.”

This is the eighteenth year that RP3 recognition has been offered. A full list of designees is available on the APPA website at: RP3 Designees.

Quick Links:

Meetings & Events

Other Resources

Current is published by MEAG Power

1470 Riveredge Parkway, N.W., Atlanta, Georgia 30328 | www.meagpower.org | (800) 333-MEAG