MEAG Power, Participant & Public Power News

Spring 2023

Understanding the Turbulent Natural Gas Market

After many years of relative stability and low market prices, 2022 was the most volatile year for natural gas prices since the era of deregulation began in the early 1990s.

The wild price fluctuations were driven by numerous unprecedented disruptions, including the war in Ukraine and an increased reliance on natural gas to fill the generation deficit as more coal plants are decommissioned and not enough replacement power has yet been added to the grid. In addition, gas pipeline capacity is lagging, coal delivery constraints limited inventories at the remaining coal plants, and severe weather events played a role in the price spikes seen during the year.

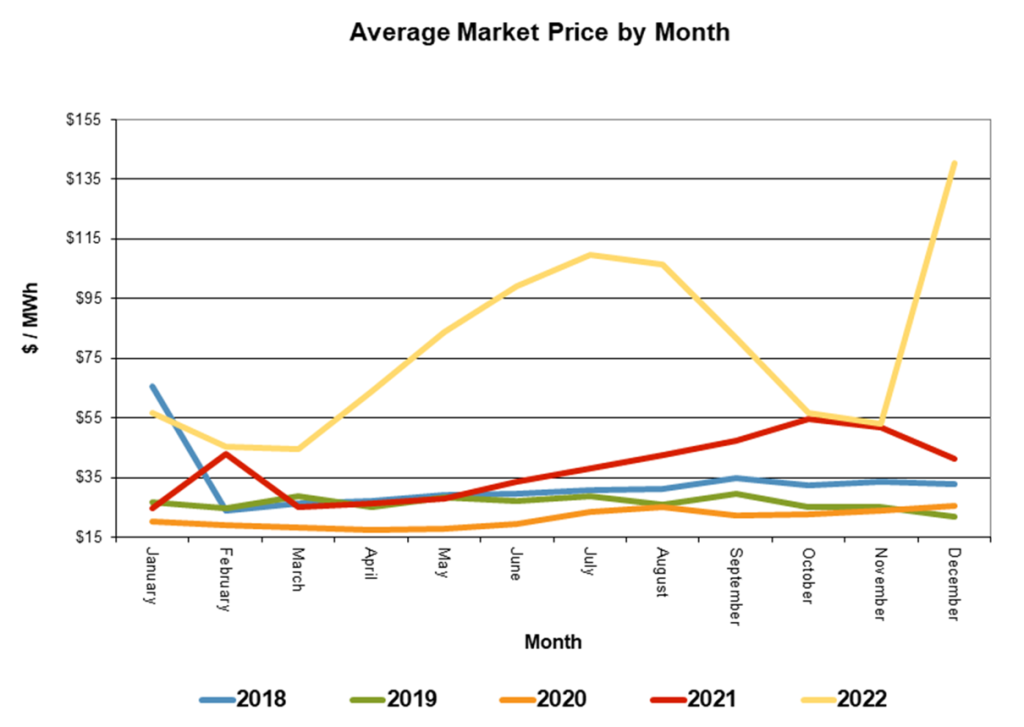

The average monthly market price for natural gas was remarkably stable for the period from February 2018 through June 2021, when it starting rising before normalizing again at year-end 2021, as shown in the chart below. In 2022, the market price was as low as about $45 per MWh and as high as about $145 per MWh.

More information about the contributing factors to this instability is helpful in understanding what an atypical year it was. And while 2023 followed that same trend line early on, there may be some relief in sight, according to research by Moody’s Investors Services, a world-renowned analytical and risk management company. However, volatility and risk of extreme pricing events are here to stay.

Non-Weather Factors

After Russia invaded Ukraine, much of Europe came to an abrupt realization that it had become overly dependent on Russian natural gas as its primary fuel source for electricity generation and heating. Some major Western European countries, led by Germany, had forsaken nuclear energy while also moving away from coal in favor of gas and renewable energy. Suddenly, much of Europe was looking for new sources of gas as Russia threatened to cut the supply entirely to countries that opposed its invasion.

Among the markets those countries tapped was the U.S. market, as shipments of liquefied natural gas (LNG) from the U.S. to Europe increased throughout the year. Commodities trading follows market pricing trends, and with European demand skyrocketing, pricing for natural gas in the U.S. market also rose.

At the same time, the demand for natural gas in the U.S. stayed strong, because of the need to fill the generation void left in the wake of ongoing coal plant retirements and limitations on coal deliveries. Despite record additions of solar and wind to the U.S. grid over the past 3-4 years, it’s not sufficient to replace the reduction in coal-fired generation being removed, and the intermittent nature and low capacity factors of solar and wind generation alone aren’t an equitable replacement for the baseload nature of coal facilities. That domestic demand likewise put upward pressure on natural gas prices.

Winter Storm Elliot

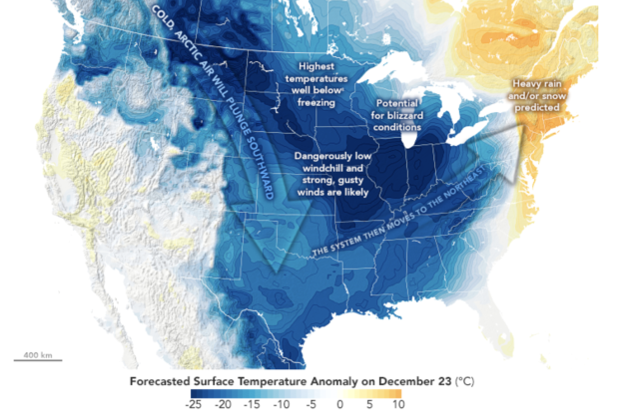

Adding to the mix at the end of an already chaotic year were unexpected pipeline distribution issues and yet another unprecedented weather event, Winter Storm Elliot, which wreaked havoc in the market in late December.

With temperatures plummeting over much of the U.S., demand for natural gas greatly increased from both home heating and electricity generation requirements. On Dec. 23, natural gas demand surged to 160 billion cubic feet (Bcf)/day with power demand 45% higher than average and residential/commercial demand 55% higher than average. The massive increase in natural gas demand required the market to utilize over 200 Bcf of natural gas storage during event. Several pipelines issued Force Majeures, limiting capacity deliverability for power generation.

The Southern Balancing Authority (SBA) enacted the Energy Emergency Alert system and issued alerts, escalating to an Energy Emergency Alert Level 2 before returning to normal operations on Dec. 26. MEAG Power enacted our emergency procedure and notified the Participants to take electric load conservation measures. Although not required in the SBA, other utilities did implement load management due to their system conditions.

All resources were available on the MEAG Power peak load hour, which occurred on Dec. 24: 1,786.3 MW. Only one generation resource was not being utilized on the peak hour: One of the Gas Turbines at Wansley 9 was not utilized due to a lack of available pipeline capacity. Plant Addison was dispatched on Fuel Oil for 41 consecutive hours — from the Friday evening peak (Dec. 23) through Sunday morning peak (Christmas day).

The only “silver lining” was the timing of this event. Load requirements were dampened by an estimated 7% compared to a non-holiday weekday, as more people were off work, lessening commercial and industrial demand. In addition, the event lasted about 2 days, which limited the impact.

Natural gas spot pricing averaged $8.49/MMBtu during the peak 5 days (Dec. 23-27), with pipeline capacity pricing averaging $47.17/MMBtu during the same period. Plant Addison was the highest priced unit dispatched, at an estimated price of $285/MWh.

Moody’s Predicts Relief

According to a recent Moody’s Investors Services research note, lower natural gas prices in 2023 will lead to a 35-45% dip in the price of on-peak power in most markets across the United States.

“Natural gas and power price expectations for 2023 have dropped steeply,” the firm said. The unusually warm winter has moderated heating demand and left gas storage facilities with inventories about 21.5% above their historical five-year averages.

“Expected 2023 natural gas prices are around 44% lower than forward market expectations in December,” Moody’s said. That has resulted in 2023 expected power prices more than 40% lower than 2022 in some regions, according to the research note, which cited S&P Global Market Intelligence data.

MEAG Power’s Projections

Although 2023 natural gas and energy market prices are lower, all of the factors contributing to December’s extreme pricing event remain. The energy market is changing from a long market — with excess generation and gas capacity — to a short market as a result of the coal plant retirements and the increased use of gas for energy demands and export.

Being short creates the environment for volatility in the markets whenever extreme weather occurs, or unexpected unit or gas pipeline outages occur. Ensuring that our resource portfolio is diverse and covers the majority of our needs can reduce risk and provide stability in cost during these extreme conditions.

Quick Links:

Meetings & Events

Other Resources

Current is published by MEAG Power

1470 Riveredge Parkway, N.W., Atlanta, Georgia 30328 | www.meagpower.org | (800) 333-MEAG