MEAG Power, Participant & Public Power News

Summer 2024

To Build or Not to Build? We’ve Reached a Tipping Point

Market and regulatory trends are pushing us to a tipping point where, together, the Participants and MEAG Power staff need to make some critical decisions on future resource supplies.

MEAG Power President and CEO Jim Fuller set the context for discussions at the recent 2024 Annual Meeting by noting that market and regulatory trends are pushing us to a tipping point where, together, the Participants and staff need to make some critical decisions on future resource supplies.

We’re coming off the commercial operation of Vogtle Unit 4, completing the biggest endeavor MEAG Power has ever undertaken. Units 3 and 4 have added 500 MW of clean, reliable energy to the portfolio. Yet that may be just a drop in the bucket compared to the potential load increase being forecast in Georgia and elsewhere over the next few years.

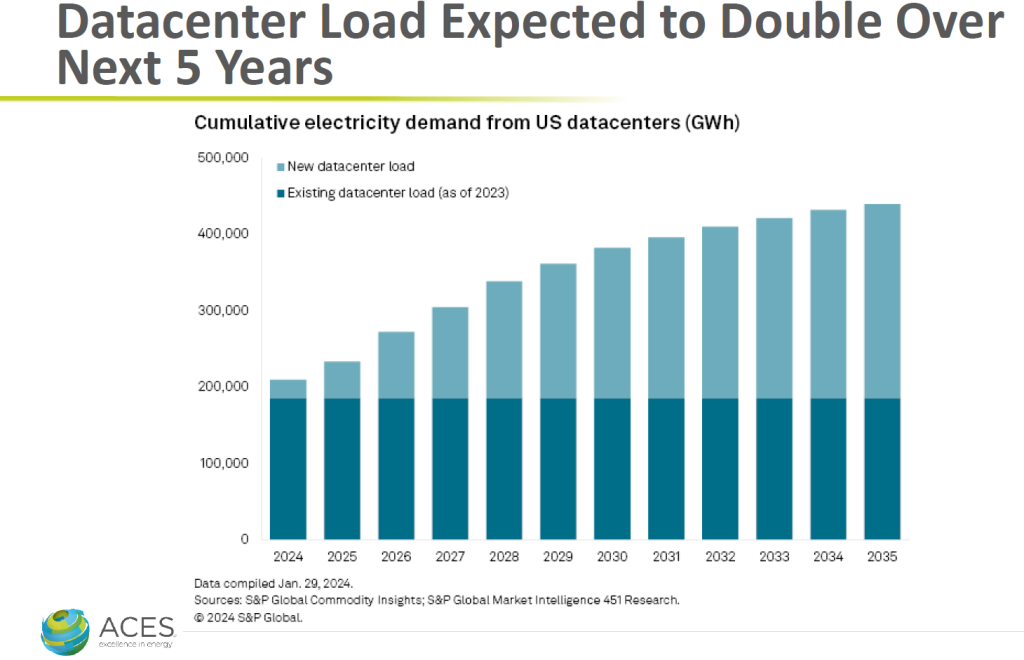

As Lakin Garth of the Smart Electric Power Alliance (SEPA) noted in his presentation, data centers were estimated to account for 4% of total U.S. electricity consumption in 2023, and are expected to grow to a potential 9.1% by 2030. ACES, MEAG Power’s new energy trading partner, supported this forecast in its Concurrent Session by citing estimates that data center load is expected to double over next five years.

That’s on top of growth in manufacturing and the increasing electrification of transportation, which also will drive increased energy demand in our communities.

In response, many energy providers across the country are making plans for new power plant construction to boost supplies. Georgia Power received approval to build 1,400 MW of new generation based on its revised demand forecast, which increased 16-fold from just two years ago. Oglethorpe Power also announced plans recently to build new gas generation totaling 1,440 MW at a cost of $2.3 billion.

In addition to higher load growth, we could be facing the early retirement of Plant Scherer, depending on the fate of recent EPA rules on greenhouse gas emissions. That’s 490 MW that would need to be replaced at a time of increasing demand.

MEAG Power’s mandate as a public power joint action agency is to provide reliable, affordable power, and make available resources that will meet future demand of our Participant communities. That becomes increasingly difficult if demand grows and the supply of power diminishes.

That leaves two options. One, keep the status quo of supplying the communities’ inherent growth. That would require only incremental investment, but it also could reduce competitiveness as other energy providers become better positioned to take on large loads.

Two, we can join together to explore additional sources of energy that can serve these bigger loads. A new project would spread risk and enable Participants to win these projects, which in turn would dilute the fixed costs and reduce the kilowatt hour rate, increase margin and enhance affordability.

To be most effective there would need to be support from a broad base of Participants who come together and agree on a feasible project model. In fact, MEAG Power requires buy-in from at least five Participants to move forward with any new project. The more Participants that join, the more we can spread risk and new revenues. No single community could build purpose-fit generation at the same affordable, low-risk option as a larger group.

And the benefits potentially are significant. There is a surge of interest at the moment among data center developers, e-mobility companies and others looking for communities that have reliable, clean and affordable energy.

EdgeConneX, a global data center company, recently paid $318.5 million for a strip of land in Union County. That’s about $5 million per acre. When hearing the price, many real estate professionals thought it was a clerical error.

EdgeConneX plans to build a $1.8 billion data center campus to serve Microsoft. The site will require the equivalent electricity to power a city of 700,000 people.

Investments like these don’t get made on a whim. The demand for power is certainly going to rise. It’s just a matter of by how much.

The loads are coming, and whether or not Participants can win their share depends on decisions this group will make over the coming months.

Attracting deals like EdgeConneX could provide substantial benefits for Participant communities. But it requires a commitment and investment now to secure enough power in the future.

New plants take time to build. At least four to five years for gas and solar construction, and more than 10 for nuclear. And that’s not counting design and development, regulatory approval, testing, and other requirements.

If we started today, we likely wouldn’t get the energy until 2029 or 2030 at the earliest.

That puts us on the clock to make some decisions.

When it comes to what type of new generation to build, MEAG Power is open to all sources. Our guiding principle is to maintain diversity and flexibility in our generation mix, so that we continually provide reliable, affordable power to your communities. To this end, we recently issued an RFP for a range of new generation sources to see what options are available and will support our needs.

As we move into the latter half of 2024, keep in mind that other providers are building generation and will be positioned to win more loads and drive down their costs. If we set up a new project in the right way, Participants could benefit from winning new loads large and small.

We look forward to having more conversations with you on these important issues.

Quick Links:

Meetings & Events

Other Resources

Current is published by MEAG Power

1470 Riveredge Parkway, N.W., Atlanta, Georgia 30328 | www.meagpower.org | (800) 333-MEAG